How will Albion explain this at the Seminar on 20 Nov?

A bit of light reading for Sunday. Just copy and enlarge the embedded image.

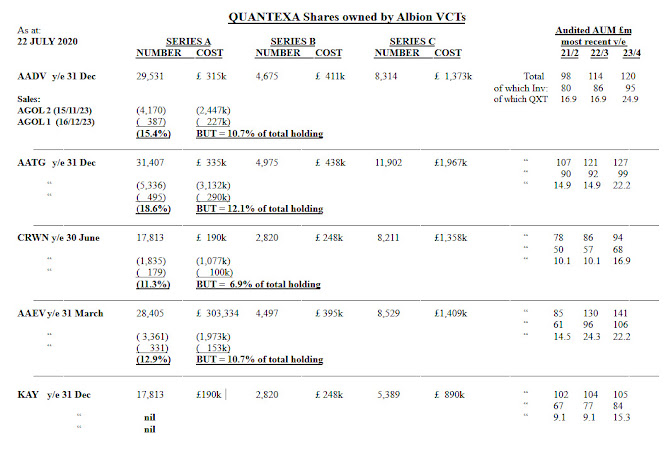

No wonder there was panic in the summer when they realised they had no choice but to "sell" Quantexa shares.- and before the December year ends of 2 of the VCTs.

BDO were told to agree to the fudge and lies on the Quantexa balance sheet Note 26, but they still lost the VCT audits - can we rely on ICAEW's investigation into BDO that they confirmed yesterday is now back on track and escalated to the next level? Coincidence - hmmm.

But how will PHR and WTF explain the different percentages for the 4 out of 5 selling VCTs? Did the Directors really approve those numbers independently, did the KAY directors agree not to top-slice for housekeeping reasons - or did everyone just accept Albion's numbers without knowing each fund was acting differently? Divide and Rule - rarely fails.

Surely it couldn't have anything to do with the 20% accrued fee matrix analysis? (oh naughty me for suggesting such thoughts! When did Albion actually last collect any carry?) Anyone upto running the spreadsheets?

Albion seem to be entirely dependent on the value of Quantexa shares for the "carry" - but then they reset the base price for themselves alone when they sold the shares to their wholly owned subsidiary at a 20% discount and only later brought in ABRDN, Hampshire County Council Pension Fund and their own members and staff independently - Nice!

Seems to me that the revaluation number at a 20% discount bears no relationship to anything at all so must have been to fit/fudge the 15% and 20% restrictive numbers imposed on, but ignored by Albion. Will we ever see the rationale for that number and the different % for each VCT? Perhaps they will answer my question at the Seminar.

And a last thought..."follow the money" .... just when and by whom did the VCT's actually get paid - how much (if any) did Albion have to borrow to cover their tracks given that the transefer dates were of "Stamped" transfers and there is a 30 day window for reporting the sales to AGOL1 and AGOL2 to HMRC?

Comments

Post a Comment